You are viewing 1 of your 1 free articles

Grenfell council and major London housing association handed first consumer ratings

The English regulator has found “serious failings” at the Royal Borough of Kensington and Chelsea (RBKC), as a third of its homes do not meet the Decent Homes Standard (DHS).

In a judgement today, the Regulator of Social Housing (RSH) gave the 9,500-home council a C3 grade, as “significant improvement is needed” on one of the consumer standards.

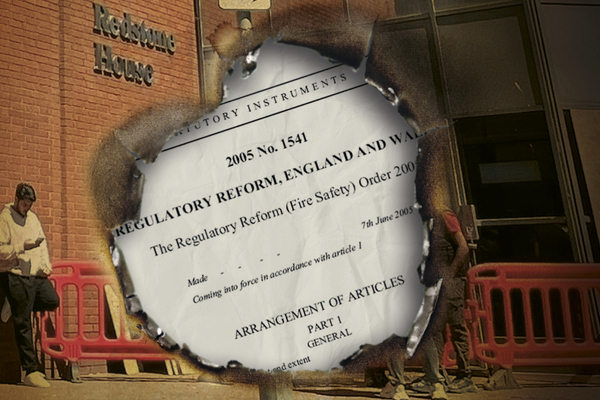

The council, which was criticised by the Grenfell Tower Inquiry, self-referred prior to the RSH’s inspection over issues around stock condition and decency.

However, RBKC pointed out that it was meeting 18 of 20 of the RSH’s “required outcomes”.

In a separate judgement today, L&Q was downgraded for governance to G2 and handed a compliant C2 grade.

At RBKC, the regulator found that only 40% of individual property surveys had been carried out within the past five years. The council also reported that 33% of its homes do not meet the DHS.

The RSH acknowledged that the council has “taken steps to mitigate any risks to tenants in the meantime and is aiming to achieve full DHS compliance by 2030”, and has set out plans to invest in its homes to reduce non-decency.

Elsewhere, the judgement said RBKC’s repairs and maintenance service meets regulatory requirements.

The RSH said it had also “gained assurance that RBKC treats tenants with fairness and respect”. The council’s tenant management organisation (TMO) was previously criticised by the Grenfell Tower Inquiry as regarding some residents as “militant troublemakers”.

Today’s judgement said the council had used insight from complaints to improve its service delivery. It had also “engaged constructively” with the RSH.

Elizabeth Campbell, leader of RBKC, acknowledged that the council needed to “better understand” the condition of homes and improve kitchens and bathrooms.

However, she added: “The report acknowledges that we are meeting 18 of the 20 required outcomes and I personally am very pleased to see positive feedback on how we engage and consult with our residents, how our repairs service works without a backlog and how we are improving neighbourhoods and tackling anti-social behaviour with our partners.”

In a separate judgement on L&Q, the regulator laid out its reasons for awarding a C2.

The RSH said it found evidence of “some weaknesses” in L&Q’s provision of repairs and maintenance services to its tenants, particularly for non-emergency repairs.

The 105,000-home landlord also needs to improve how it keeps its stock condition records up to date, the RSH said.

The judgement said there was evidence that L&Q is “managing the risks to its tenants from damp, mould and condensation”. However, it said the group needs to improve how it is prioritising cases “according to risk and how it considers the diverse needs of tenants when undertaking remediation work”.

The RSH said the landlord provided “evidence-based assurance that it has appropriate systems in place to ensure the health and safety of its tenants in their homes and associated communal areas”.

On its governance, the English regulator found board reporting on repairs, damp and mould and decent homes “required some improvement”.

It concluded that the “depth and quality” of board reporting on how L&Q delivers on stock quality outcomes was not “fully aligned with its agreed risk appetite”.

L&Q is also delivering a “significant change programme” focused on increasing investment in existing tenants’ homes and services, and has “already identified and made changes needed to support this”. The landlord kept its V2 rating for financial viability.

Fiona Fletcher-Smith, chief executive of L&Q, said the association welcomed the judgement and the regulator’s feedback.

“Overall, we are very pleased to remain compliant with regards to governance and viability, and to have achieved a C2 against the new consumer standards,” she said.

“The regulator has acknowledged the significant progress we have made against our stated objectives to improve existing homes and services for residents while maintaining financial stability, and also recognised that we know where we have work to do.”

At the same time, 7,000-home landlord Saxon Weald was also downgraded to G2.

The regulator identified “weaknesses” in the West Sussex-based landlord’s approach to procurement and some financial controls. “This resulted in an overspend in relation to fire safety actions which was not identified until after costs had been incurred.”

The judgement said Saxon Weald needed to strengthen its governance arrangements to ensure they “operate effectively to identify, alert and highlight potential budget overspends”.

The RSH said: “Saxon Weald has been transparent and co-regulatory in its engagement with us and has moved swiftly to take appropriate action to manage the risks associated with the overspend and determine the underlying causes.

“We are satisfied that Saxon Weald is taking action to address these issues and improve its controls.”

In response, Corinna Bishopp, chief executive of Saxon Weald said: "We recognise the importance of strengthening our oversight on property safety and financial controls and are in full agreement with the regulator. "Our comprehensive action plan is actively addressing these areas, with targeted initiatives to improve our understanding of property conditions and better respond to the individual needs of our customers."

She said it was already seeing improvements, such as a fall in overdue safety actions and "enhanced data collection" on homes.

"These improvements will help us deliver safe, quality homes and more responsive services for our customers," Ms Bishopp added.

Saxon Weald also has C2/V2 grades with the regulator.

Sign up for our regulation and legal newsletter

Already have an account? Click here to manage your newsletters

Latest stories