You are viewing 1 of your 1 free articles

Shared owners could face service charges for private flats if London landlord wins appeal

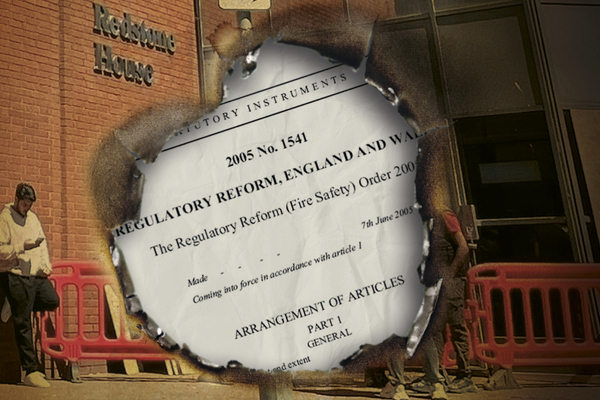

Shared owners at a block in Battersea could be left footing the bill for services provided to private flatowners on a large estate as Notting Hill Genesis (NHG) seeks to challenge an earlier tribunal ruling.

The appeal comes after a first-tier tribunal ruling in July found that the shared owners’ sub-leases do not permit the London landlord to charge them for services such as a gym, concierge and communal gardens.

NHG argued during the proceedings that “the fact that a tenant derives no benefit from a service is irrelevant to whether they are contractually bound to pay for it”.

The judge rejected the residents’ argument that it would be “morally wrong” to require them to contribute towards services they did not benefit from.

He added: “The tribunal would have determined the applicants were required to contribute to the costs of the development if it wording/covenants of sub-leases required the applicants do so.”

The judge described the sub-leases as “poorly drafted” and found the wording/covenants did not require the shared ownership leaseholders to contribute towards the costs of services provided to private flatowners in the wider development.

The tribunal found that the wording of the sub-leases require shared owners only to contribute to the costs of repairing and maintaining their block (V1) and contributing to the services that are provided to it. They are not required to contribute to the wider costs, which NHG is required to pay as headleasee.

The issue has arisen as Barratt Homes granted NHG a headlease on block V1 for a term of 155 years from 1 June 2006. This is the only Viridian Apartments headlease held by NHG.

As it does not hold a headlease for the flats in the private blocks (V2 to V7), the landlord is still liable for the expenditure on the whole development.

Janine, a key worker and shred ownership leaseholder who purchased her shared ownership flat in 2009, said: “At the time, I took all the necessary steps to ensure that the home I was purchasing was financially affordable, not just in the short run but also over the long term. I made sure to check with my conveyancing solicitor that I wouldn’t be charged for the concierge and other services on the wider development.

“Yet since 2014, NHG have continued to force me to pay far more in service charges than my lease allows for.

“More recently, it has resulted in a huge legal bill for us leaseholders, many of whom remain key workers on salaries that make service charges demanded of us completely unaffordable.”

The judge said: “The tribunal rejects the [leaseholders’] arguments that it would be ‘morally wrong’ to require them to contribute towards costs of the development to which they had no access.

“The tribunal finds it is incumbent on the leaseholders and their legal advisors to ensure that the terms of a lease accurately reflects their understanding of what they are contractually required to contribute, even if they receive no benefit.

“Therefore, the tribunal would have determined the applicants were required to contribute to the costs of the development if it wording/covenants of sub-leases required the applicants do so.”

This case comes amid growing concerns over the shared ownership model. A 2024 report by the Levelling Up, Housing and Communities Committee (now the Housing, Communities and Local Government Committee) found that uncapped service charges, rising rents and unfair maintenance costs mean shared ownership is unaffordable, and that owners are left “regretting having made the purchase in the first place”.

Among other recommendations, the report said the government should improve lease terms for shared owners through ensuring they are only liable for repairs and maintenance costs proportionate the size of their stake in the property.

Emails obtained by Inside Housing after the report revealed that the Ministry of Housing, Communities and Local Government and Homes England were “unimpressed” by the suggested recommendations.

Earlier this year, the Shared Ownership Council, a cross-sector initiative, created a new shared ownership code. The organisation hopes this will improve customer service and satisfaction through creating a standardised model that providers can sign up to.

Sue Phillips, founder of Shared Ownership Resources, said: “This isn’t simply a legal issue. There’s a moral principle at stake.

“Entrants to the shared ownership scheme should be able to place reliance on the affordability promise and shouldn’t have to spend their hard-earned cash fighting their social housing landlords in the courts.”

Sign up for our regulation and legal newsletter

Already have an account? Click here to manage your newsletters

Related stories